Garment Industry

Garment Industry started developing in Bangladesh in the late 1970s when the high-cost producers, for example, US, EU, etc moved to low cost countries for outsourcing their merchandises. It was the foreign buyers who initially motivated the Bangladeshi entrepreneurs to manufacture apparels under special terms and conditions to export. The first consignment, a small one to be sure, was exported from Bangladesh in 1978. The industry grew rapidly and became an economic powerhouse for several reasons. Of them the most important was the interest of the foreign buyers to have apparels made in Bangladesh under subcontracting arrangements because the production cost (labour-intensive cutting, stitching, trimming and packing, etc) was lowest in Bangladesh. Beside, unskilled trainable labour was abundantly available at a low cost. On the top of it, foreign buyers and partners ensured technological and marketing support, and provided an innovative financing vehicle, Back-to-Back L/C facility that solved the problem of working capital for the Bangladeshi exporters. On the other hand, Bangladeshi entrepreneurs got interested because it was a low technology and low-investment industry, and marketing- the most difficult task- was the responsibility of the foreign buyers. In addition, reforms in international textile trade regime, particularly Multifibre Arrangements and its off-shoot Quota System opened up an unprecedented opportunity for the least developed countries. This opportunity provided Bangladesh with almost captive markets for export of apparels to USA and some other countries. This played an important role to facilitate the growth of this industry. In addition, the GSP privileges granted by EU helped this industry grow rapidly. Because of these reasons, the large retailers in European Union and USA found it much more profitable to have their merchandises made in Bangladesh, and then import from Bangladesh back to their own counties for retailing. However the apparels exported from Bangladesh were for low end of the markets concentrating on shirts for men, later on adding a smaller quantity jackets, trousers, women's wear and other items.

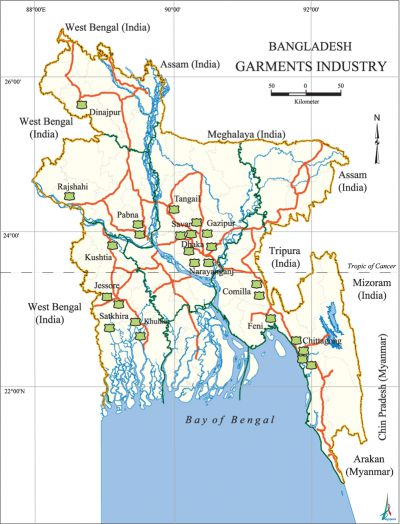

By 1985 Dhaka and Chittagong became homes of hundreds of garment factories. In the textile supply chain, the roles of the Buying Houses got prominence. Large retailers outsourced their merchandises through buying houses that placed orders to Bangladeshi RMG manufacturers. Over times, the situation improved a lot. Bangladeshi entrepreneurs excelled in establishing both backward and forward linkages. At the initial years, Bangladesh was 100% dependent on the imported raw materials (fabrics) and accessories to run their factories. By creating backward linkages, they have successfully reduced their dependence on the imported raw materials, namely, yarn, fabrics, dyeing, processing, printing and finishing technology by building domestic capacity. By this time a large number of composite mills were established. Meanwhile, due to increase in the demand for knitwear in EU markets, a major product diversification occurred in Bangladesh. Bangladesh started exporting an increasing quantity of knitwear, in addition to woven wear. Total export earnings from both woven wear and knitwear increased sharply. Eventually, foreign exchange earnings from knitwear exceeded that from woven wear. It was possible because Bangladesh established an increasing number of composite mills. Bangladesh now locally produces about 60% fabrics for exportable woven wear and almost 95% for knitwear. In developing forward linkages also, Bangladeshi entrepreneurs marched forward. There are large composite mills including RMG factories; some of them are completely owned by Bangladeshis, some by foreign companies and some are joint- ventures. Quite a number of them have their own marketing outfits that negotiate directly with the big European and US retailers. All these mean that the RMG industry is in strong footing. In fact, the economy of Bangladesh is greatly dependent on the RMG industry.

The RMG sector rapidly attained high importance in terms of employment, foreign exchange earnings and its contribution to GDP. Even in 1999, the industry employed directly more than 1.5 million workers, about 76% of whom were female. With the growth of RMG industry, linkage industries supplying yarns, fabrics, accessories, packaging materials, etc. have also expanded. In addition, demand for services like transportation, banking, shipping and insurance has increased. All these have created additional employment.

The total direct and indirect employment created by the RMG industry in Bangladesh is estimated to be some 2.5 million. (1999). The hundred percent export-oriented RMG industry experienced phenomenal growth during the last 15 or so years. In 1978, there were only 9 garment manufacturing units, which generated a small amount of export earnings. These factories served both domestic and export markets. Desh Garments Ltd, the first 100% export-oriented garment industry was established in 1979... It was really a milestone. Desh had tremendous impact on the growth, development and expansion of the RMG industry in Bangladesh. In fact, Desh is considered 'Mother' of the RMG industry. It had technical and marketing collaboration with Daewoo Corporation of South Korea. Another South Korean Firm, Youngones Corporation formed the first equity joint-venture garment factory with a Bangladeshi firm in 1980. Bangladeshi partners contributed 51% of the equity of the new firm, named Youngones Bangladesh. It exported its first consignment in December 1980.

Till the end of 1982, there were only 47 garment manufacturing units. The breakthrough occurred in 1984-85, when the number of garment factories rose to 587. The number of RMG factories shot up to around 2,900 in 1999. By this time, Bangladesh became one of the 12 largest apparel exporters of the world, the sixth largest supplier in the US market and the fifth largest supplier of T-shirts in the EU market. The industry has grown during the 1990s roughly at the rate of 22%. It is to be noted that in the past, until 1980, jute and jute goods topped the list of merchandises exported from Bangladesh and generated more than 50% of the total export earnings. By late 1980s, RMG exports replaced jute and jute goods and became the number one in terms of the value of exports.

In 1983-84, RMG exports earned only $0.9 billion, which was 3.89% of the total export earnings of Bangladesh. In 1998-99, the export earnings of the RMG sector were $5.51 billion, which was 75.67% of the total export earnings of the country. The net foreign exchange earnings were, however, only about 30% of the figures quoted above because approximately 70% of the foreign exchanges earned were spent in importing the raw materials and accessories to produce the garments exported.

Both external and internal factors contributed to the phenomenal growth of RMG sector. One external factor was the application of the GATT-approved Multifibre Arrangement (MFA) which accelerated international migration of garment production from high-cost to low-cost countries. Under MFA, large importers of RMG like USA and Canada imposed quota restrictions, which limited export of apparels from countries like Hong Kong, South Korea, Singapore, Taiwan, Thailand, Malaysia, Indonesia, Sri Lanka and India to USA and Canada. On the other hand, application of MFA worked as a blessing for Bangladesh. As a least developed country, Bangladesh received preferential treatment from the USA and European Union (EU). Initially Bangladesh was granted quota-free status. To maintain competitive edge in the world markets, the traditionally large suppliers/producers of apparels followed a strategy of relocating RMG factories in countries, which were free from quota restrictions and at the same time had enough trainable cheap labour. They found Bangladesh as a promising country.

By 1985, Bangladesh emerged as a strong apparel supplier and became a powerful competitor for traditional suppliers in the US, Canadian and European markets. But, since 1986, Bangladesh had been increasingly subjected to quota restrictions by USA and Canada.

RMG industry suffered setback in a number of countries in the 1980s. Some countries had internal problems, for example, Sri Lanka; and some other countries of Southeast Asia experienced rapid increase in labour cost. Buyers looked for alternative sources. Bangladesh was an ideal one as it had both cheap labour and large export quotas. The EU continued to grant Bangladesh quota-free status and GSP privileges. In addition, USA and Canada allocated substantially large quotas to Bangladesh. These privileges guaranteed Bangladesh assured markets for its garments in USA, Canada and EU. The domestic factor that contributed to the growth of RMG industry, as is well known, was the comparative advantage Bangladesh enjoyed in garment production because of low labour cost. The domestic policies of the successive governments contributed to the rapid growth of this sector. The governments provided various kinds of incentives such as duty-free import of fabrics under back-to-back L/C, bonded warehouse facilities, concessionary rates of interest; cash export incentive, export processing zone facilities, etc. The governments also took a number of pragmatic steps to streamline export-import formalities.

Market Diversification There are several weaknesses the RMG industry of Bangladesh suffers from. This industry is highly vulnerable because it is almost completely dependent on the mercy of two large markets, namely, EU (48%) and US (46%) markets. More than 94% of its apparels are shipped to these two markets. As a separate market Canada is also a cherished destination for Bangladesh apparels. However, volume is very small, around 3% of the total apparel export. The rest 3% are exported to more than 40 small markets. If for some reason, the consumers in these two markets cannot or do not buy Bangladesh garments large enough quantity, the industry which is the largest employer is likely to collapse, and in turn Bangladesh economy will be in jeopardy. The industry leaders individually and also through BGMEA collectively with the support of EPB and Government are trying to diversify markets. There are many potential markets, the larger are India, China and Japan. Beside ASEAN countries, European countries other than the members of EU, SAARC countries, Russia, Australia and Latin America have good potential.

Recently, under a bi-lateral agreement India has allowed Bangladesh to export to India 46 specific items duty-free. Many people believe that this is a modest beginning of getting free access to the very large market. Several years ago Bangladesh was granted limited duty-free access for a few selected items to Japanese market. The business leaders believe that Japanese market offers higher prospect than India or China although initial hope was dashed by the negative impact of Tsunami. But after recovery from Tsunami disaster, apparel export to Japan has increased and this increase is likely to continue. Bangladesh has already exported to China. China imports from Bangladesh because its labour cost has gone up. It is cheaper for China to source cheaper apparel from Bangladesh where cost is lower. But because of language and other barriers export is growing very slowly. Anyhow, Bangladesh cannot afford not to diversify its market, but it must look for new markets without looking for replacement of US and EU markets.

Product Diversification Another weakness of this industry is the lack of product diversification. Bangladesh has specialized in exporting mostly inexpensive apparels. Its export basket should contain diversified products. It needs to try to export products for high end markets in addition to products for low end markets. It is reported that industry leaders have taken some steps to penetrate into high end markets of US, EU and several other markets It is to be noted that the innovative, enthusiastic and' farsighted entrepreneurs of Bangladesh have started increasing their investment in pharmaceuticals, leather products, light engineering, power generating equipment, small ocean going shipbuilding, and similar non-traditional exports. So export basket is getting bigger with overall product diversification.

Labour Productivity Bangladesh faces many bottlenecks to remain competitive. One is its low labour productivity. Labour productivity in the RMG sector of Bangladesh is lower than many of its competitors. Bangladeshi workers are not as efficient as those of Hong Kong, South Korea and some other countries. Beside, most factories in Bangladesh do not or cannot use the latest production technologies and management practices. The benefit of cheap labour is often neutralized by low labour productivity. As the industry has matured, the supply of skilled labour has become scarce. It is no longer true that employable labour is abundantly available. In response, BGMEA, the apex body of the garment manufacturers and exporters has embarked on skill development training programmes for floor workers and managers. Beside, the infrastructure in the country is deplorably underdeveloped. A long hour of power outage substantially reduces labour efficiency and disrupts delivery commitment. Inadequate port facilities result in frequent port congestion, which delays shipment. All these increase the lead-time to process an order, i.e. the time from the date of receiving an order to the date of shipment. The industry leaders and government are aware of all these problems. The Sixth Five Year Plan has emphasized the need for skill development action plans, infrastructure development plans, and urgently resolve the power supply problems.

Weathering Recent Global Recession Since 1985 through 2004 the industry grew rapidly with some occasional sluggishness. But when MFA was phased out many experts predicted a doom of Bangladeshi garment industry. But thanks to the insightful entrepreneurs the industry is still riding strong. Similarly, when the bell of global recession rang, many people feared that RMG industry would not have the strength to survive. But Bangladesh again proved that it could face any challenge.

In spite of global recession, the apparel exports from Bangladesh have continued to grow, however, with occasional short-lived sluggishness. Bangladesh exports survived the global financial crisis in 2008, because it supplied mostly inexpensive items that did not face the negative substitution impact of the fall in disposable income of the consumers in the EU and US markets. The ship carrying garments from Bangladesh did not sink; rather the exports continue to grow.

The export figures for most recent 3 years quoted from EPB sources below show this clearly.

| Year | Products | in US$ million | Total in US$ million |

| 2008-09 | Knitwear | 6426 | --- |

| Woven | 5916 | --- | |

| Total | 12342 | --- | |

| 2009-10 | Knitwear | 6483 | --- |

| Woven | 6013 | --- | |

| Total | 12496 | --- | |

| 2010-11 | Knitwear | 9482 | --- |

| Woven | 8432 | --- | |

| Total | 17914 | --- |

The RMG Industry is the flagship and a success story of Bangladesh in spite of' its ups and downs. As in the early stages, from the beginning of the Third Millennium, the RMG exports grew steadily. According to Export Promotion Bureau (EPB),' during the first decade of the 21st century when the whole world was worried about global recession, the country (Bangladesh) stood up proudly as' the world's second largest apparel supplier, after China. Garment exports stood at $17.91 billion in fiscal 2010-11, taking up almost 78% of the overall exports. And at same time, leading position of Knitwear continued. Of the total apparel exports, Knitwear accounted for $9.49 billion, while woven was $8.43 billion in fiscal 2010-11. During the first decade of the Third Millennium 2001-2010, the average growth of the garment export was more than 13% and that of Knitwear more than 15%. This industry is the largest employer, employing 3 million men and women, mostly women. If one adds the employment that occurs through backward and forward linkage industries, the total employment would be around 6 million. Its contribution to GDP is estimated to be between 7% and 8%.

The RMG industry is not only the driving force of the economy, the largest exporter and foreign exchange earner of the country and largest employer; it has also played a major role in changing the society. In addition to its economic contribution, the expansion of the RMG industry has caused noticeable social changes by bringing more than 2.10 million women into labour force. The economic empowerment of these working girls/women has changed their status in the family. The attractive opportunity of employment has changed the traditional patriarchal hegemony of the fathers, brothers and husbands. Most working women/girls can now chose when to get married or become mothers. The number of early marriages is decreasing; so is the birth rate; and the working girls tend to send their little brothers and sisters to school, as a result, the literacy rate is increasing. They can participate in family decision-making. Most importantly, the growth of RMG sector produced a group of entrepreneurs who have created a strong private sector. Of these entrepreneurs, a sizeable number is female. A woman entrepreneur established one of the oldest export-oriented garment factories, the Baishakhi Garment as early as 1977. Many women hold top executive positions in RMG industry. In no other industry empowerment of women is so visible and pervasive. [Hafiz GA Siddiqi]