Balance of Payments: Difference between revisions

(Content Updated.) |

No edit summary |

||

| Line 1: | Line 1: | ||

'''Balance of Payments''' is a record of official estimates of all transactions between two countries during a year. It shows the sum total of all external transactions arising from export and import of goods and services and transfers, such as remittances and capital inflows and outflows (transactions on capital account). Bangladesh has experienced deficits in its balance of trade since its independence and the problem became chronic because of the country's heavy dependence on imports and at the same time, its requirement for running development programmes. The sharp increase in oil prices during the early 1970s enhanced the import payments for crude oil, petroleum products and fertilisers. | '''Balance of Payments''' is a record of official estimates of all transactions between two countries during a year. It shows the sum total of all external transactions arising from export and import of goods and services and transfers, such as remittances and capital inflows and outflows (transactions on capital account). Bangladesh has experienced deficits in its balance of trade since its independence and the problem became chronic because of the country's heavy dependence on imports and at the same time, its requirement for running development programmes. The sharp increase in oil prices during the early 1970s enhanced the import payments for crude oil, petroleum products and fertilisers. | ||

The [[Bangladesh Bank|bangladesh bank]] prepares balance of payments (BOP) positions of the country following the IMF Balance of Payments Manual. The data are derived from various sources such as foreign exchange transaction records of authorised dealers, documents of the Ministry of Food on import of food grain by the government, documents of Ministry of Finance on imports financed through foreign loans and grants, and custom records for the preparation of BOP. Despite adoption of various export promotion measures and rising trend in wage earners remittances, the disequilibrium in the balance of payments position persisted. The increased liberalisation of the external sector during the 1990s also contributed to the widening of the gap in the trade balance of the country during this period. After currency convertibility in 1993 FX market condition and FX reserve position started getting better. During 2002 to 2016 (except 2005, 2011 and 2012) current account of BOP maintained surplus. It was one of the important turning points of Bangladesh economy to take in the emerging stage. Afterward, 2017 to 2021 current account balance showed deficit. At the end of June 2021 deficit was USD 3.8 billion. However, a healthy position of foreign exchange reserves (equivalent to 9 months of important bill payment), remittance and FDI inflow and sufficient level of domestic investment (30% plus since 2017 to onward) might bring back BOP favorable position soon. SDR balance reached at USD 1.09 billion at the end of December 2020. | |||

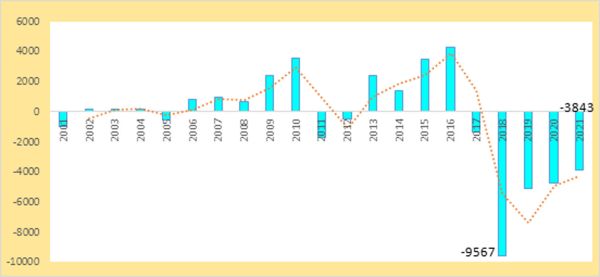

''Figure'' 1 Current Account Balance of BOP, Bangladesh (million USD) | |||

[[Image:BalanceofPayments.jpg|right|thumbnail|600px|''Sources'' Economic Trend and BBQ, April-June 2021, Bangladesh Bank.]] | |||

Despite liberalisation of import trade of the country, improvements in current account deficit continued during the late 1990s due mainly to increase in export receipts, decline in deficits in services account, and increase in wage earner's remittances. The account became positive in FY 1997 and continued to be so till FY2000. The positive or surplus situation was brought back again in FY 2002 and continued to FY 2016 excluding a few exceptions. Though the current account showed a deficit in FY 2017 to 2021, the deficit is getting down gradually. The external sector’s overall situation is proven to have a stable outlook. | |||

''Table 1'' Balance of Payment of Bangladesh FY 2011-2020 (million US dollar). | |||

{| class="table table-bordered table-hover" | {| class="table table-bordered table-hover" | ||

|- | |- | ||

| Items || FY | | Items || FY 2011 || FY 2012 || FY 2013 || FY 2014 || FY 2015 || FY 2016 || FY 2017 || FY 2018 || FY 2019 || FY 2020 | ||

|- | |- | ||

| | |Export f.o.b || 22,592 || 23,989 || 26,567 || 29,777 || 30,697 || 33,441 || 34,019 || 36,285 || 39,604 || 32,832 | ||

|- | |- | ||

| | |Import f.o.b || 32,527 || 33,309 || 33,576 || 36,571 || 37,662 || 39,901 || 43,491 || 54,463 || 55,439 || 50,690 | ||

|- | |- | ||

| Trade Balance | |Trade Balance || -9,935 || -9,320 || -7,009 || -6,794 || -6,965 || -6,460 || -9,472 || -18,178 || -15,835 || -17,859 | ||

|- | |- | ||

| Services (net) || - | |Services (net) || -2,612 || -3,001 || -3,162 || -4,096 || -3,186 || -2,708 || -3,288 || -4,201 || -3,177 || -2,541 | ||

|- | |- | ||

| Income | |Primary Income (net) || -1,454 || -1,549 || -2,369 || -2,635 || -2,252 || -1,915 || -1,870 || -2,641 || -2,993 || -3,106 | ||

|- | |- | ||

| | |Secondary Income || 12,315 || 13,423 || 14,928 || 14,934 || 15,895 || 15,345 || 13,299 || 15,453 || 16,903 || 18,780 | ||

|- | |- | ||

| | |Of which Workers' Remittances || 11,513 || 12,734 || 14,338 || 141,16 || 15,170 || 14,717 || 12,769 || 14,703 || 16,196 || 18,014 | ||

|- | |- | ||

| Current Account Balance | |Current Account Balance || -1,686 || -447 || 2,388 || 1,409 || 3,492 || 4,262 || -1,331 || -9,567 || -5,102 || -4,723 | ||

|- | |- | ||

| Capital Account || | |Capital Account || 642 || 482 || 629 || 598 || 496 || 464 || 400 || 331 || 239 || 256 | ||

|- | |- | ||

| Financial Account || | |Financial Account: || 651 || 1,436 || 2,863 || 2,813 || 1,267 || 944 || 4,247 || 9,011 || 5,907.2 || 7,537 | ||

|- | |- | ||

| FDI || | |1. FDI || 775 || 1,191 || 1,726 || 1,432 || 2,525 || 2,502 || 3,038 || 3,290 || 4,946 || 3,234 | ||

|- | |- | ||

| Portfolio Investment || | |2. Portfolio Investment || 109 || 240 || 368 || 937 || 379 || 139 || 457 || 349 || 172 || 44 | ||

|- | |- | ||

| Other Investments (Net) || - | |3.Other Investments (Net) || -233 || 5 || 769 || 444 || -284 || -480 || 2,137 || 6,884 || 3,108 || 6,222 | ||

|- | |- | ||

| Errors and Omissions || | |Errors and Omissions || -1,376 || -977 || -752 || 663 || -882 || -634 || -147 || -632 || -865.2 || -145 | ||

|- | |- | ||

| Overall Balance || | |Overall Balance || -656 || 494 || 5128 || 5,483 || 4,373 || 5,036 || 3,169 || -857 || 179 || 2,925 | ||

|} | |} | ||

''Source'' Bangladesh Bank. | ''Source'' Bangladesh Bank. | ||

Decline in import growth coupled with steady export growth narrowed the trade deficit at the end of FY 2002. From 2002 to 2016, except for a couple of years, the current account of BOP maintained surpluses. As a result, Bangladesh Taka started to get stronger against the US dollar and it brought stability in the exchange rate. After FY 2017, the current account returned to its deficit position, gradually decreasing the deficit but continued to FY 2021. However, FX reserve at satisfactory level (equivalent to 9 months import payment), maintaining competitiveness of Bangladeshi garments in international market (2nd position), FDI and remittance inflow and satisfactory level of domestic investment (30%plus) indicates return back to current account surplus soon. [Syed Ahmed Khan and A Samad Sarker] | |||

[[Category:Financial Institutes]] | [[Category:Financial Institutes]] | ||

[[bn:লেনদেন ভারসাম্য]] | [[bn:লেনদেন ভারসাম্য]] | ||

Latest revision as of 20:32, 13 October 2023

Balance of Payments is a record of official estimates of all transactions between two countries during a year. It shows the sum total of all external transactions arising from export and import of goods and services and transfers, such as remittances and capital inflows and outflows (transactions on capital account). Bangladesh has experienced deficits in its balance of trade since its independence and the problem became chronic because of the country's heavy dependence on imports and at the same time, its requirement for running development programmes. The sharp increase in oil prices during the early 1970s enhanced the import payments for crude oil, petroleum products and fertilisers.

The bangladesh bank prepares balance of payments (BOP) positions of the country following the IMF Balance of Payments Manual. The data are derived from various sources such as foreign exchange transaction records of authorised dealers, documents of the Ministry of Food on import of food grain by the government, documents of Ministry of Finance on imports financed through foreign loans and grants, and custom records for the preparation of BOP. Despite adoption of various export promotion measures and rising trend in wage earners remittances, the disequilibrium in the balance of payments position persisted. The increased liberalisation of the external sector during the 1990s also contributed to the widening of the gap in the trade balance of the country during this period. After currency convertibility in 1993 FX market condition and FX reserve position started getting better. During 2002 to 2016 (except 2005, 2011 and 2012) current account of BOP maintained surplus. It was one of the important turning points of Bangladesh economy to take in the emerging stage. Afterward, 2017 to 2021 current account balance showed deficit. At the end of June 2021 deficit was USD 3.8 billion. However, a healthy position of foreign exchange reserves (equivalent to 9 months of important bill payment), remittance and FDI inflow and sufficient level of domestic investment (30% plus since 2017 to onward) might bring back BOP favorable position soon. SDR balance reached at USD 1.09 billion at the end of December 2020.

Figure 1 Current Account Balance of BOP, Bangladesh (million USD)

Despite liberalisation of import trade of the country, improvements in current account deficit continued during the late 1990s due mainly to increase in export receipts, decline in deficits in services account, and increase in wage earner's remittances. The account became positive in FY 1997 and continued to be so till FY2000. The positive or surplus situation was brought back again in FY 2002 and continued to FY 2016 excluding a few exceptions. Though the current account showed a deficit in FY 2017 to 2021, the deficit is getting down gradually. The external sector’s overall situation is proven to have a stable outlook.

Table 1 Balance of Payment of Bangladesh FY 2011-2020 (million US dollar).

| Items | FY 2011 | FY 2012 | FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | FY 2018 | FY 2019 | FY 2020 |

| Export f.o.b | 22,592 | 23,989 | 26,567 | 29,777 | 30,697 | 33,441 | 34,019 | 36,285 | 39,604 | 32,832 |

| Import f.o.b | 32,527 | 33,309 | 33,576 | 36,571 | 37,662 | 39,901 | 43,491 | 54,463 | 55,439 | 50,690 |

| Trade Balance | -9,935 | -9,320 | -7,009 | -6,794 | -6,965 | -6,460 | -9,472 | -18,178 | -15,835 | -17,859 |

| Services (net) | -2,612 | -3,001 | -3,162 | -4,096 | -3,186 | -2,708 | -3,288 | -4,201 | -3,177 | -2,541 |

| Primary Income (net) | -1,454 | -1,549 | -2,369 | -2,635 | -2,252 | -1,915 | -1,870 | -2,641 | -2,993 | -3,106 |

| Secondary Income | 12,315 | 13,423 | 14,928 | 14,934 | 15,895 | 15,345 | 13,299 | 15,453 | 16,903 | 18,780 |

| Of which Workers' Remittances | 11,513 | 12,734 | 14,338 | 141,16 | 15,170 | 14,717 | 12,769 | 14,703 | 16,196 | 18,014 |

| Current Account Balance | -1,686 | -447 | 2,388 | 1,409 | 3,492 | 4,262 | -1,331 | -9,567 | -5,102 | -4,723 |

| Capital Account | 642 | 482 | 629 | 598 | 496 | 464 | 400 | 331 | 239 | 256 |

| Financial Account: | 651 | 1,436 | 2,863 | 2,813 | 1,267 | 944 | 4,247 | 9,011 | 5,907.2 | 7,537 |

| 1. FDI | 775 | 1,191 | 1,726 | 1,432 | 2,525 | 2,502 | 3,038 | 3,290 | 4,946 | 3,234 |

| 2. Portfolio Investment | 109 | 240 | 368 | 937 | 379 | 139 | 457 | 349 | 172 | 44 |

| 3.Other Investments (Net) | -233 | 5 | 769 | 444 | -284 | -480 | 2,137 | 6,884 | 3,108 | 6,222 |

| Errors and Omissions | -1,376 | -977 | -752 | 663 | -882 | -634 | -147 | -632 | -865.2 | -145 |

| Overall Balance | -656 | 494 | 5128 | 5,483 | 4,373 | 5,036 | 3,169 | -857 | 179 | 2,925 |

Source Bangladesh Bank.

Decline in import growth coupled with steady export growth narrowed the trade deficit at the end of FY 2002. From 2002 to 2016, except for a couple of years, the current account of BOP maintained surpluses. As a result, Bangladesh Taka started to get stronger against the US dollar and it brought stability in the exchange rate. After FY 2017, the current account returned to its deficit position, gradually decreasing the deficit but continued to FY 2021. However, FX reserve at satisfactory level (equivalent to 9 months import payment), maintaining competitiveness of Bangladeshi garments in international market (2nd position), FDI and remittance inflow and satisfactory level of domestic investment (30%plus) indicates return back to current account surplus soon. [Syed Ahmed Khan and A Samad Sarker]