Foreign Exchange Reserve: Difference between revisions

(Content Updated.) |

No edit summary |

||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

'''Foreign Exchange Reserve''' the stock of foreign currencies a country holds to buffer out imbalances between foreign receipts and payments. | '''Foreign Exchange Reserve''' the stock of foreign currencies a country holds to buffer out imbalances between foreign receipts and payments. BANGLADESH BANK, the central bank of the country, holds the stock of convertible foreign exchange reserve of the country in the form of liquid assets. In the first 2-3 years after liberation, the foreign exchange reserve of the country was composed mainly of aid/grants and export earnings. Subsequently, Bangladesh diversified export products and expanded its export base. It could also geographically diversify the direction of the export trade by exploring new areas. The export earnings gradually emerged as the main source of the country's foreign exchange reserves. In 1974, Bangladesh introduced the WAGE EARNERS’ SCHEME, which, by now, has become a significant source of foreign exchange. Bangladesh receives financial assistance from IMF under various arrangements, which also constitutes an important source of the foreign exchange reserve of the country. Moreover, as its member, Bangladesh receives additional SDR allocations from IMF. Historically, the foreign exchange reserves of Bangladesh have been largely inadequate compared to its needs for financing imports, meeting debt service liabilities, and paying for factor earnings of the foreign nationals. A growing demand for foreign exchange emanated from people travelling abroad for education, training and medical service outside the country. | ||

Since liberation, Bangladesh had been following a very restrictive import policy and rationing scarce foreign exchange. In the process of economic reform and liberalisation, restrictive policies were gradually replaced by liberal policies. Generally, the reserve position of a country is determined by factors such as vulnerability in | Since liberation, Bangladesh had been following a very restrictive import policy and rationing scarce foreign exchange. In the process of economic reform and liberalisation, restrictive policies were gradually replaced by liberal policies. Generally, the reserve position of a country is determined by factors such as vulnerability in BALANCE OF PAYMENTS, the speed of reserve depletion, opportunity cost of holding reserves, and the international liquidity position. The supply of primary exportables from Bangladesh is inelastic in the short run and the country is dependent on imports for supply of industrial consumer goods, machinery and industrial raw materials. The prices of imported goods often fluctuate. As a result, the balance of payments situation remains under pressure. The balance is influenced by internal shocks generating from damages caused by floods or droughts as well external shocks originating from declines in prices of exportables or rise in prices of imported goods. | ||

Bangladesh does not have easy access to international liquidity, particularly to commercial credit, and the availability of funds from official sources is subject to various conditionalities. This is why Bangladesh has to maintain a reasonable level of foreign exchange reserve equivalent to an amount that covers payment for at least about 3 months' imports. The trend of the reserve shows no uniform growth although there had been a rise in export earnings as well as workers' remittances. The reserves of $122 million recorded during 1981-82 were equivalent to less than a month's import payment. This occurred due to mainly a substantial decline in the prices of the country's exportables, suspension of IMF's Extended Fund Facility Programme, and lower aid disbursement. Amidst fluctuations, the reserves reached a peak level of $3.37 billion in April 1995 and then declined to $1.3 billion or equivalent to about 2 months | Bangladesh does not have easy access to international liquidity, particularly to commercial credit, and the availability of funds from official sources is subject to various conditionalities. This is why Bangladesh has to maintain a reasonable level of foreign exchange reserve equivalent to an amount that covers payment for at least about 3 months' imports. The trend of the reserve shows no uniform growth although there had been a rise in export earnings as well as workers' remittances. The reserves of $122 million recorded during 1981-82 were equivalent to less than a month's import payment. This occurred due to mainly a substantial decline in the prices of the country's exportables, suspension of IMF's Extended Fund Facility Programme, and lower aid disbursement. Amidst fluctuations, the reserves reached a peak level of $3.37 billion in April 1995 and then declined to $1.3 billion or equivalent to about 2 months of import payment in December 2001. | ||

Bangladesh floated her currency in May 2003 to maintain a viable external position, encourage inflow of remittances and maintain competitiveness of Bangladeshi products in the international market. From then the Authorised dealers are free to quote their own spot and forward exchange rate for interbank transactions and for transactions with the non-bank customers. Moreover a lot of changes have been brought in the country's foreign exchange reserve management techniques and strategies after floating of Bangladeshi taka which are basically influenced by the development in the' financial markets and the aspects of policy environment in which the Bangladesh Bank has to operate. The major consideration of Bangladesh Bank's foreign exchange reserve management techniques and strategies are the monetary policy of the country, current account balance of the country, external debt position and the condition in international financial market. | Bangladesh floated her currency in May 2003 to maintain a viable external position, encourage inflow of remittances and maintain competitiveness of Bangladeshi products in the international market. From then the Authorised dealers are free to quote their own spot and forward exchange rate for interbank transactions and for transactions with the non-bank customers. Moreover, a lot of changes have been brought in the country's foreign exchange reserve management techniques and strategies after floating of Bangladeshi taka which are basically influenced by the development in the' financial markets and the aspects of policy environment in which the Bangladesh Bank has to operate. The major consideration of Bangladesh Bank's foreign exchange reserve management techniques and strategies are the monetary policy of the country, current account balance of the country, external debt position and the condition in international financial market. | ||

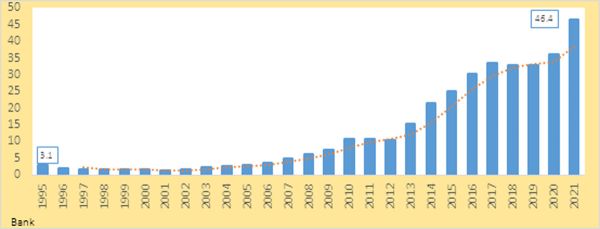

''Figure 1'' Bangladesh Official Foreign Exchange Reserve (billion USD) | |||

[[Image:ForeignExchangeReserve.jpg|right|thumbnail|600px|''Sources'' ''Economic Trend Bangladesh Bank Quarterly'', April-June 2021, Bangladesh]] | |||

There have been remarkable improvements in the foreign exchange reserve position of the country in the last two decades up to 30th June of 2021 (see figure 1). From a lowest level of 1.3 billion in 2001 foreign exchange reserve started rising continuously and exceeded US $ 10.0 billion' and in November 2009. Steady growth of export earnings and robust growth of worker's remittances mainly contributed this. The country's foreign exchange reserve reached a level of more than 10.7 billion on 30th June 2010 showing a compound' growth of more than 23 per cent per annum in the last 9 years. This amount of reserve is equivalent to about 6 months import payments. Bangladesh Bank, as a reserve management technique diversifies its foreign exchange reserve and maintains the balances among a number of international reputed central bank as well as commercial banks having good credit ratings determined by international rating agencies. To minimize exchange rate risk, currency composition has been also diversified among major currencies. Keeping in view the stipulated liquidity restrictions as well as market and liquidity risk factors Bangladesh Bank also diversifies its international portfolio into Treasury Bills, Repos and other short-term international money market instruments and corporate bonds etc. It may be mentioned that during the sever worldwide financial crises in FY 08, Bangladesh Bank had to keep a vigilant eye on placement/investment of its international reserve with the banks affected by U.S subprime crises and took judicious decisions to protect from undue losses. The reserves were withdrawn quickly from a number of commercial banks, which later on become bankrupt and deposited to some central bank. The steps proved to be very effective and fruitful. At the end of June 2021, the balance of the official reserve of Bangladesh rose to USD 46.4 billion equivalent to 9 months import bill payment. [Syed Ahmed Khan and A Samad Sarker] | |||

[[bn:বৈদেশিক মুদ্রা মজুত]] | [[bn:বৈদেশিক মুদ্রা মজুত]] | ||

Latest revision as of 16:52, 15 October 2023

Foreign Exchange Reserve the stock of foreign currencies a country holds to buffer out imbalances between foreign receipts and payments. BANGLADESH BANK, the central bank of the country, holds the stock of convertible foreign exchange reserve of the country in the form of liquid assets. In the first 2-3 years after liberation, the foreign exchange reserve of the country was composed mainly of aid/grants and export earnings. Subsequently, Bangladesh diversified export products and expanded its export base. It could also geographically diversify the direction of the export trade by exploring new areas. The export earnings gradually emerged as the main source of the country's foreign exchange reserves. In 1974, Bangladesh introduced the WAGE EARNERS’ SCHEME, which, by now, has become a significant source of foreign exchange. Bangladesh receives financial assistance from IMF under various arrangements, which also constitutes an important source of the foreign exchange reserve of the country. Moreover, as its member, Bangladesh receives additional SDR allocations from IMF. Historically, the foreign exchange reserves of Bangladesh have been largely inadequate compared to its needs for financing imports, meeting debt service liabilities, and paying for factor earnings of the foreign nationals. A growing demand for foreign exchange emanated from people travelling abroad for education, training and medical service outside the country.

Since liberation, Bangladesh had been following a very restrictive import policy and rationing scarce foreign exchange. In the process of economic reform and liberalisation, restrictive policies were gradually replaced by liberal policies. Generally, the reserve position of a country is determined by factors such as vulnerability in BALANCE OF PAYMENTS, the speed of reserve depletion, opportunity cost of holding reserves, and the international liquidity position. The supply of primary exportables from Bangladesh is inelastic in the short run and the country is dependent on imports for supply of industrial consumer goods, machinery and industrial raw materials. The prices of imported goods often fluctuate. As a result, the balance of payments situation remains under pressure. The balance is influenced by internal shocks generating from damages caused by floods or droughts as well external shocks originating from declines in prices of exportables or rise in prices of imported goods.

Bangladesh does not have easy access to international liquidity, particularly to commercial credit, and the availability of funds from official sources is subject to various conditionalities. This is why Bangladesh has to maintain a reasonable level of foreign exchange reserve equivalent to an amount that covers payment for at least about 3 months' imports. The trend of the reserve shows no uniform growth although there had been a rise in export earnings as well as workers' remittances. The reserves of $122 million recorded during 1981-82 were equivalent to less than a month's import payment. This occurred due to mainly a substantial decline in the prices of the country's exportables, suspension of IMF's Extended Fund Facility Programme, and lower aid disbursement. Amidst fluctuations, the reserves reached a peak level of $3.37 billion in April 1995 and then declined to $1.3 billion or equivalent to about 2 months of import payment in December 2001.

Bangladesh floated her currency in May 2003 to maintain a viable external position, encourage inflow of remittances and maintain competitiveness of Bangladeshi products in the international market. From then the Authorised dealers are free to quote their own spot and forward exchange rate for interbank transactions and for transactions with the non-bank customers. Moreover, a lot of changes have been brought in the country's foreign exchange reserve management techniques and strategies after floating of Bangladeshi taka which are basically influenced by the development in the' financial markets and the aspects of policy environment in which the Bangladesh Bank has to operate. The major consideration of Bangladesh Bank's foreign exchange reserve management techniques and strategies are the monetary policy of the country, current account balance of the country, external debt position and the condition in international financial market.

Figure 1 Bangladesh Official Foreign Exchange Reserve (billion USD)

There have been remarkable improvements in the foreign exchange reserve position of the country in the last two decades up to 30th June of 2021 (see figure 1). From a lowest level of 1.3 billion in 2001 foreign exchange reserve started rising continuously and exceeded US $ 10.0 billion' and in November 2009. Steady growth of export earnings and robust growth of worker's remittances mainly contributed this. The country's foreign exchange reserve reached a level of more than 10.7 billion on 30th June 2010 showing a compound' growth of more than 23 per cent per annum in the last 9 years. This amount of reserve is equivalent to about 6 months import payments. Bangladesh Bank, as a reserve management technique diversifies its foreign exchange reserve and maintains the balances among a number of international reputed central bank as well as commercial banks having good credit ratings determined by international rating agencies. To minimize exchange rate risk, currency composition has been also diversified among major currencies. Keeping in view the stipulated liquidity restrictions as well as market and liquidity risk factors Bangladesh Bank also diversifies its international portfolio into Treasury Bills, Repos and other short-term international money market instruments and corporate bonds etc. It may be mentioned that during the sever worldwide financial crises in FY 08, Bangladesh Bank had to keep a vigilant eye on placement/investment of its international reserve with the banks affected by U.S subprime crises and took judicious decisions to protect from undue losses. The reserves were withdrawn quickly from a number of commercial banks, which later on become bankrupt and deposited to some central bank. The steps proved to be very effective and fruitful. At the end of June 2021, the balance of the official reserve of Bangladesh rose to USD 46.4 billion equivalent to 9 months import bill payment. [Syed Ahmed Khan and A Samad Sarker]