Wage Earners’ Scheme

Wage Earners’ Scheme was introduced in 1974 to provide incentives to the Bangladeshi nationals working abroad in remitting their earnings to Bangladesh through official channel. The scheme got prominence when the allocation of foreign exchange for importers at official rate was curtailed due to a fall in the foreign exchange reserves. The scheme aimed at conversion of remittances of the Bangladeshi workers at exchange rates corresponding approximately to the open market rate. Importers facing shortage of foreign exchange allocations tended to buy foreign exchange at rates higher than the official rate from the wage earners' market, which was popularly known as the secondary foreign exchange market. Remittances by workers from abroad play a significant role in minimising dependence on aid for foreign exchange. Remittances treated as earnings through 'manpower export' have become the largest foreign exchange earner among the items in the balance of trade.

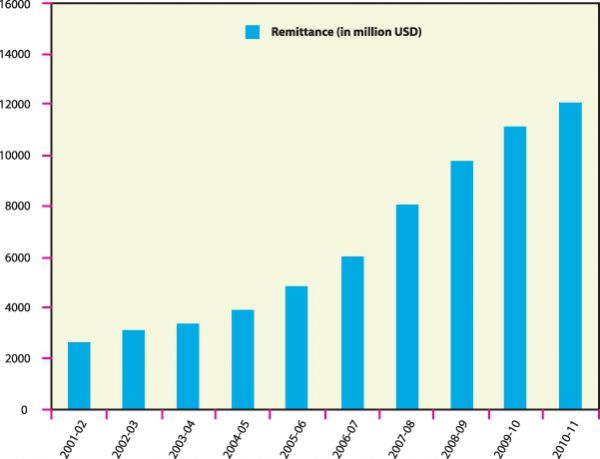

Starting with a small amount of $11.8 million in 1974-75, the size of remittances rose to $378.74 million in 1980-81 and to $764.00 million in 1990-91. The amount stood at $1.7 billion at the end of 1998-99. Bangladesh is considered as one of the major labour exporting countries of the world. Since independence over 7.4 million Bangladeshis went abroad to work. A new vista for employment opportunities in the Middle Eastern countries in the mid-1970s contributed to increase the Bangladeshi labour migration. The number of overseas employment was only 17,000 persons in 1977-78 and increased to 38,456 persons in 1980-81. The number grew to 96,697 persons in 1990-91 and to 270,490 in 1998-99. The remittances-GDP ratio was 2.67% in 1980-81, 3.26% in 1990-91 4.68% in 1998-99. Remittances under the Wage Earners' Scheme were 14.09% of import payments in 1980-81. The ratio rose to 21.76% in 1990-91 and to 21.30% in 1998-99. The Kingdom of Saudi Arabia tops the list of sources of foreign remittances to Bangladesh. Its share was 36.35% of the total in 1983-84 and it rose to 40.15% in 1998-99. The share of remittances from Kuwait that occupies the second position was 13.50% in 1998-99. In the FY of 2010-11, the volume of remittance has rose to around USD 11,650.30 million that is 11.12% of GDP. The ratio of remittance-GDP drops down to 10.54% whereas was 10.95% in the FY of 2009-10. The labour migration scenario of Bangladesh is highly country specific. Total labour migration from Bangladesh is increasing but it is also highly dependent on the Middle East countries, Saudi Arabia, UAE, Qatar, Oman, Bahrain, Kuwait, Libya, Iraq, Singapore and Malaysia. The percentage of labour migration has dropped down in the recent years due to the economic recession, Middle Eastern political unrest and squeeze in the demand of labour markets. In FY 2010-11, a total of 0.45 million people have migrated from the country which was 6.04% more than that of FY 2009-10. Current political unrest in these Middle Eastern countries might cause an adverse effect on migration and remittance balance for Bangladesh.

Flow of remittance (since 2001-02 to 2011-12).

Source Bangladesh Economic Update: Remittance, 8 September 2011, Unnayan Onneshan, Dhaka, p. 9.

[Syed Ahmed Khan]